Basics of Bookkeeping - What Every Small Business Owner Should Know

Crucial Basic Bookkeeping Methods and Concepts

When starting a small business, it's crucial to have a solid understanding of basic bookkeeping methods to track your financial transactions accurately and efficiently. Here are some key bookkeeping methods and concepts that small business owners should be familiar with:

- Single-entry bookkeeping: This is a simple method that records only one entry for each transaction. It's suitable for very small businesses or sole proprietorships with few transactions. Single-entry bookkeeping involves recording transactions as either income or expenses in a cash book or spreadsheet.

- Double-entry bookkeeping: This is a more comprehensive system that records two entries for each transaction: a debit and a credit. This method helps maintain accurate records and ensures that the accounting equation (Assets = Liabilities + Equity) always balances. Double-entry bookkeeping is the industry standard and is recommended for most small businesses.

- Cash basis accounting: This method records transactions only when cash is received or paid out. It's a simple approach to bookkeeping and is suitable for small businesses with straightforward financial transactions.

- Accrual basis accounting: Accrual accounting records transactions when they are incurred, regardless of when cash changes hands. This method provides a more accurate representation of a business's financial health and is recommended for businesses with more complex transactions.

- Chart of accounts: This is a list of all the accounts used in a business's bookkeeping system. It includes assets, liabilities, equity, revenues, and expenses. A well-organized chart of accounts makes it easier to record and track transactions accurately.

- Bank reconciliation: This process involves comparing your business's internal financial records with your bank statement to ensure accuracy and identify any discrepancies. Regular bank reconciliations help detect errors, prevent fraud, and maintain accurate financial records.

- Financial statements: Small business owners should be familiar with basic financial statements, such as the balance sheet, income statement (profit and loss statement), and cash flow statement. These reports provide valuable insights into a business's financial health and performance.

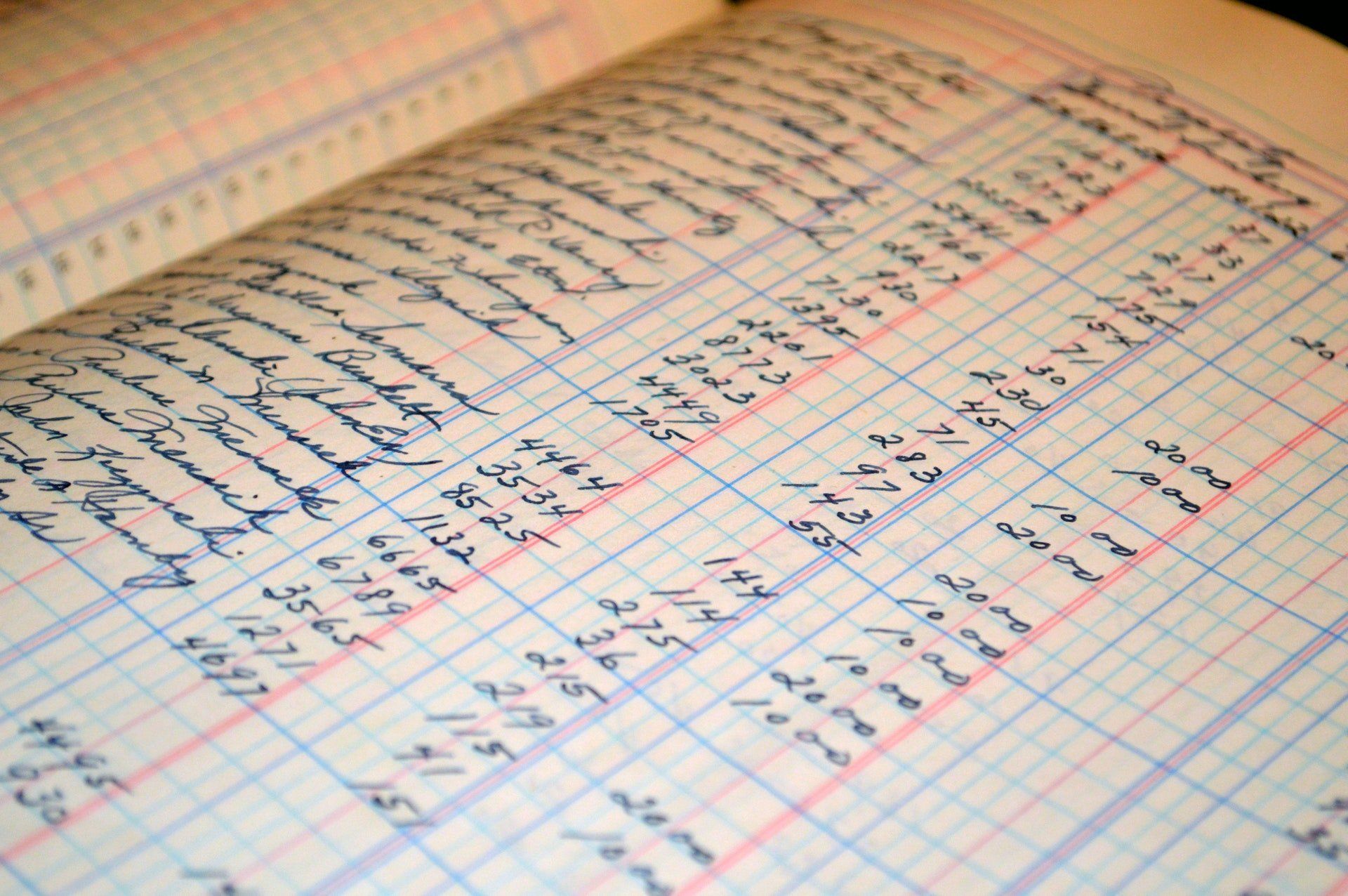

- Recordkeeping: Maintain accurate and organized records of all financial transactions, including invoices, receipts, and other documents. Good recordkeeping practices make it easier to prepare financial statements, file taxes, and monitor business performance.

- Tax compliance: Small business owners should be aware of their tax obligations, including sales tax, payroll tax, and income tax. Keeping accurate records and understanding relevant tax laws can help you comply with regulations and avoid penalties.

- Basic accounting software: Many small businesses use accounting software to streamline their bookkeeping processes. Familiarize yourself with popular options like QuickBooks, Xero, or FreshBooks, which can help automate transactions, generate reports, and simplify tax preparation.

Understanding and implementing these basic bookkeeping methods will help small business owners maintain accurate financial records, make informed decisions, and ensure compliance with tax and regulatory requirements.